If You Need Help:

Call Us at 718.884.5900 or Email info@rssny.org

(Translation Services Available)

CELEBRATE!

RSS is here in whatever way you prefer: In-Person or Online.

RSS In-Person

RSS Online

RSS in the Community

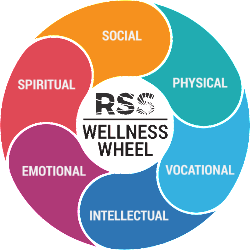

Focusing on Wellness In All Aspects of our Programs and Services

RSS: The Center for Ageless Living is more than just a meeting place. RSS is a place for emotional, cultural and physical engagement. We're a multi-faceted center - an exercise studio, an arts studio, dance floor, lunch spot and social hub - all in one place!

RSS champions older adults and their friends and families by giving community members the opportunity to live better, happier and healthier lives.

All programs and services are free to any one 60+. We are located in the Bronx, New York.

Come join us! We are the Center for Ageless Living.

Today at RSS